Keyword Focus: Term vs ULIP vs Endowment

🪄 Introduction: Insurance or Investment? You Can’t Afford to Guess

Imagine this: You’re 28, recently married, and just got a hefty salary hike. You want to “secure the future” — your family’s and your own. A friend tells you to get a ULIP. Your parents say Endowment plans are safer. But your colleague swears by Term Insurance. So what’s the right choice?

If you’re confused between Term vs ULIP vs Endowment, you’re not alone. Understanding the nuances of Term vs ULIP vs Endowment is essential for making an informed decision.

Each plan comes with promises — protection, returns, tax benefits. But their core objectives differ drastically.

In this post, we’ll break down the differences, pros and cons, costs, returns, and ideal buyers for each insurance plan type. By the end, you’ll know exactly which one makes sense for you. Let’s dive deeper into Term vs ULIP vs Endowment and find out what fits your needs.

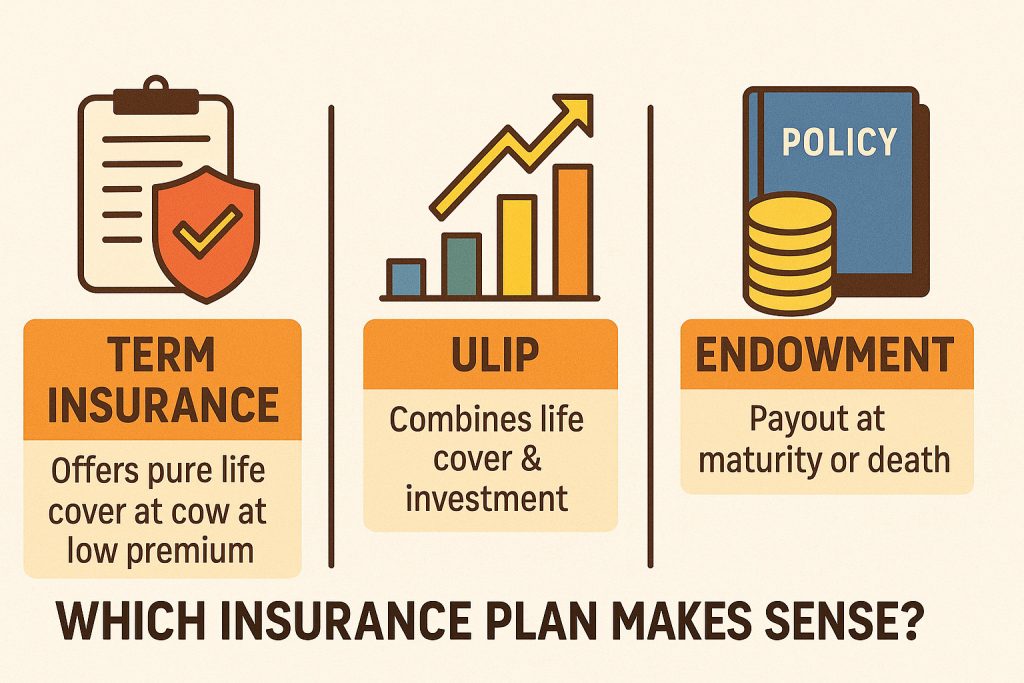

💡 The Basics: What Are These Plans?

🔹 Term Insurance: Pure Protection

- What it is: A life insurance plan that offers high coverage at low premium.

- Purpose: Financial protection for your dependents if you die during the policy term.

- Returns: None. If you survive the term, there’s no payout.

🔸 ULIP (Unit Linked Insurance Plan): Protection + Investment

- What it is: A combo of life cover and market-linked investment.

- Purpose: Gives life cover + invests your premium in equity/debt funds.

- Returns: Depends on market performance. Partial withdrawal possible.

🟠 Endowment Plan: Insurance + Guaranteed Savings

- What it is: Life cover with guaranteed or declared returns.

- Purpose: Build a savings corpus with low risk and get insurance cover.

- Returns: Fixed maturity amount, bonuses in some plans. Returns are modest.

🆚 Term vs ULIP vs Endowment: Feature-by-Feature Comparison

| Feature | Term Insurance | ULIP | Endowment Plan |

|---|---|---|---|

| Coverage Amount | High (₹1 Cr+) | Moderate | Low to Moderate |

| Premiums | Very Low | Medium to High | High |

| Maturity Benefit | None | Fund Value (market-based) | Sum Assured + Bonuses |

| Investment Component | No | Yes (market-linked) | Yes (guaranteed/declared) |

| Tax Benefit – 80C | Yes | Yes | Yes |

| Tax on Maturity | NA | Yes (conditions apply) | Yes |

| Liquidity | No | Partial after 5 years | Limited |

| Risk Level | Very Low | Moderate to High | Low |

| Best For | Protection Seekers | Risk-tolerant, long-term savers | Conservative savers |

🔍 In-Depth Breakdown: Which Plan Works When?

1️⃣ Term Insurance

Pros:

- High coverage for low cost

- No confusion, easy to understand

- Best for protection-only needs

Cons:

- No return if you survive the term

2️⃣ ULIP

Pros:

- Investment + insurance combined

- Tax-free maturity possible

- Partial withdrawals after 5 years

Cons:

- Charges are higher

- Returns are not guaranteed

3️⃣ Endowment

Pros:

- Guaranteed or declared returns

- Bonus accumulation possible

- Tax benefits

Cons:

- Returns often lower than inflation

- Low flexibility/liquidity

🧠 Myth Buster Section

- Myth: Term insurance is a waste if you survive.

Fact: It protects your family at very low cost. - Myth: ULIPs always give better returns than mutual funds.

Fact: ULIPs have charges; SIPs may perform better net of costs. - Myth: Endowment is the safest investment.

Fact: Safe, yes — but low returns and not inflation-beating.

💰 Real Case Study

| Scenario | Term + SIP | ULIP | Endowment |

|---|---|---|---|

| Annual Contribution | ₹10K (Term) + ₹40K (SIP) | ₹50K | ₹50K |

| Tenure | 20 years | 20 years | 20 years |

| Cover | ₹1 Cr | ₹10–15 Lakhs | ₹7–10 Lakhs |

| Maturity Value | ₹25–30 Lakhs | ₹22–24 Lakhs | ₹13–15 Lakhs |

🧾 Tax Benefits Comparison

| Plan Type | Section 80C | 10(10D) Maturity | Tax Lock-in | Notes |

|---|---|---|---|---|

| Term | Yes | No | None | Only premium deductible |

| ULIP | Yes | Yes (if conditions met) | 5 years | Tax-free if <10% of cover |

| Endowment | Yes | Yes | 2 years | Usually tax-free |

🎯 Final Thoughts

- Choose Term Plan – if your focus is family protection and affordability, especially in light of the Term vs ULIP vs Endowment comparison.

- Choose ULIP – if you want long-term investment + insurance under one plan, integrating aspects of Term vs ULIP vs Endowment.

- Choose Endowment – if you want guaranteed returns and low risk when weighing Term vs ULIP vs Endowment.

🔗 You May Also Like

📢 Share This Post

SEO Meta Description: Confused between Term, ULIP, and Endowment plans? Compare features, benefits, and returns to choose the insurance plan that makes sense for you. Discover the key differences in Term vs ULIP vs Endowment to make an informed choice.