You’ve Probably Heard of NPS… But Are You Using It Smartly? 💭

Most salaried Indians have heard of the National Pension System (NPS).

But here’s the truth:

Only a small percentage use it right — and fewer truly understand how powerful it is.

Done right, NPS can:

- 🛡️ Slash your tax bill by ₹15,600 every year

- 💰 Build a ₹1 Cr retirement corpus over time

- 💼 Cost you less than your monthly food delivery bill

This post shows you how to use NPS smartly — with real-life examples, tips, myth-busting, asset mix ideas, and a free calculator.

🧠 What is NPS? A Quick Refresher

NPS is a government-backed retirement scheme where you invest regularly and get a pension/corpus after age 60.

✅ Open to all citizens (18–70 years)

✅ Regulated by PFRDA

✅ You choose your asset mix

✅ Contributions are locked till 60 (with exceptions)

🎯 Who Should Use NPS?

- Salaried Indians earning ₹7L–₹20L/year

- Anyone maxing out 80C

- People who want a low-cost, tax-saving retirement tool

- Those who need help sticking to long-term goals

💰 Case Study: How Raj Used NPS to Save Tax & Build ₹1 Cr

Meet Raj, 29, earns ₹10 lakh/year in Bangalore.

His tax issue: Already maxed out 80C with EPF + ELSS

His goal: Build long-term wealth AND reduce tax

His solution: Invest ₹50,000/year in NPS (Section 80CCD(1B))

Results:

- Saves ₹15,600 every year in tax

- At 10% return, corpus grows to ₹1 Cr+ by age 60

- Zero effort after auto-debit

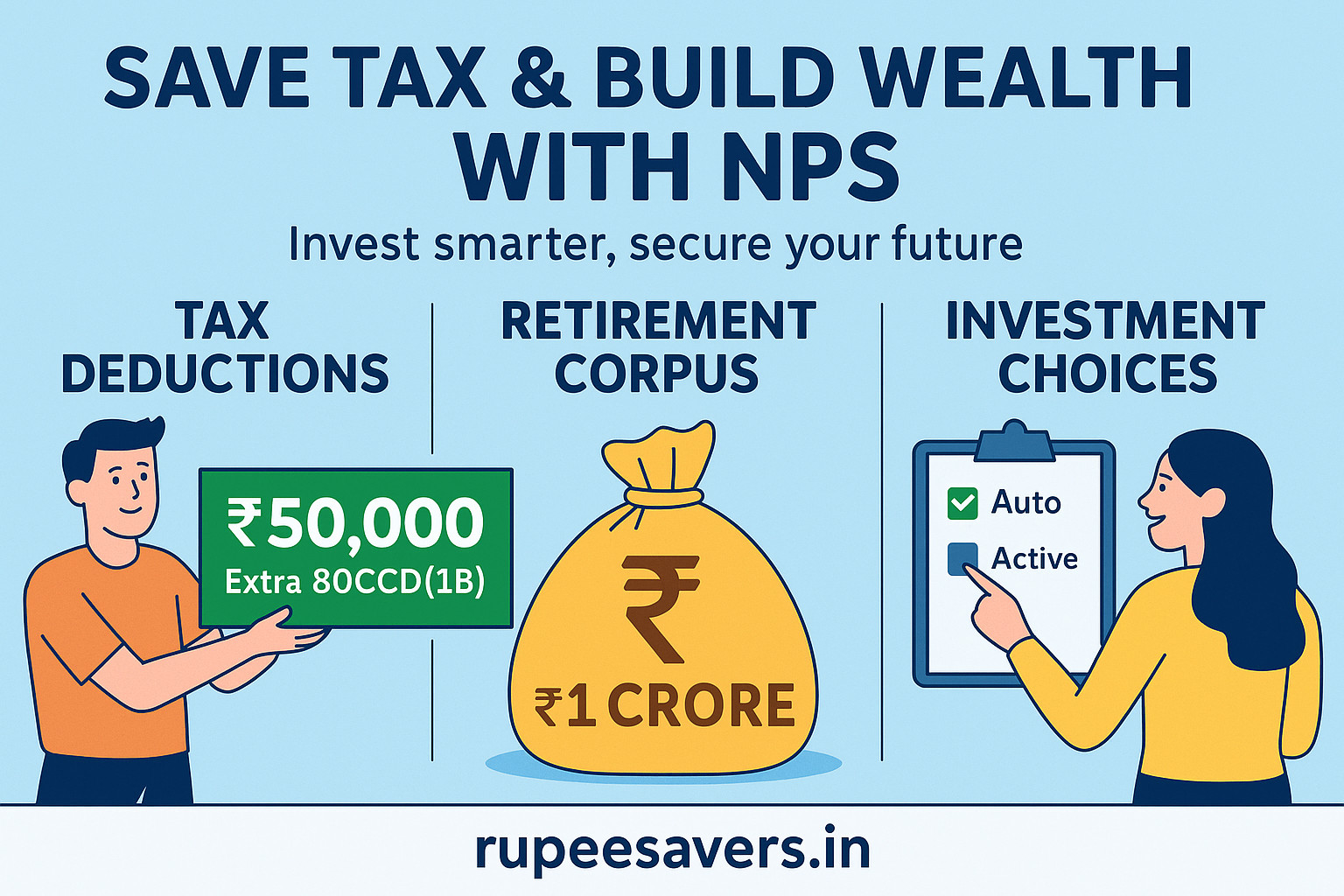

📦 NPS Tax Benefits – The Real Deal

✅ Section 80CCD(1B) – Extra ₹50,000 deduction

- Over and above 80C (₹1.5L limit)

- Saves up to ₹15,600 in tax per year

- Works under the old regime

✅ Section 80CCD(2) – Employer Contribution

- Up to 10% of basic salary

- Not counted in 80C limit

- Best if your company matches contributions

📊 NPS Tax + Wealth Calculator

| Input | Value |

|---|---|

| Age when starting | 29 |

| Yearly contribution | ₹50,000 |

| Expected return (p.a.) | 10% |

| Years until age 60 | 31 |

| Final Corpus | ₹96.3 lakh |

| Tax Saved per year | ₹15,600 |

| Total tax saved (31 yrs) | ₹4.8 lakh |

💡 Imagine building ₹1 Cr corpus + saving ₹5L in tax — just by investing ₹4K/month.

🔍 NPS vs PPF vs ELSS: Which One’s Better?

| Feature | NPS | PPF | ELSS |

|---|---|---|---|

| Tax Benefit | ₹50K extra (80CCD) | Under 80C only | Under 80C only |

| Lock-in | Till age 60 | 15 years | 3 years |

| Returns (avg) | 8%–11% | 7%–8% | 10%–14% |

| Equity Exposure | ✅ Yes | ❌ No | ✅ Yes |

| Risk Level | Medium | Low | Medium-High |

💡 Pro tip: Use all 3 together. NPS = long-term base. ELSS = growth. PPF = safety.

⚙️ NPS Asset Allocation Options

When you open your NPS account, you pick one of these modes:

🔹 Auto Choice

NPS auto-adjusts your exposure based on age

- Aggressive: More equity early

- Moderate: Balanced

- Conservative: More debt

🔹 Active Choice

You control:

- Up to 75% in equity (E)

- Rest in corporate (C) and govt bonds (G)

📑 Sample NPS Asset Mix Based on Risk Appetite

| Risk Type | Equity (E) | Corporate Debt (C) | Govt Securities (G) |

|---|---|---|---|

| Aggressive | 75% | 15% | 10% |

| Balanced | 50% | 30% | 20% |

| Conservative | 25% | 35% | 40% |

💡 You can change the allocation 2 times/year

💡 You can switch between auto & active anytime

✅ Step-by-Step: How to Open Your NPS Account

Step 1: Visit enps.nsdl.com

Step 2: Click on “National Pension System” → Register

Step 3: Enter Aadhaar/PAN, verify with OTP

Step 4: Choose Tier I account (tax benefit)

Step 5: Pick Pension Fund Manager (e.g., ICICI, HDFC, SBI)

Step 6: Choose Auto or Active asset allocation

Step 7: Upload photo, signature, and pay ₹500+

Done! You get a PRAN number + login.

📦 Myth vs Fact: Let’s Clear the Air

| Myth | Fact |

|---|---|

| “NPS is locked forever” | Partial withdrawals allowed for health, education, etc. |

| “Returns are too low” | Equity options deliver 10%+ long-term |

| “It’s only for retirement” | It’s also a great tax-saving tool now |

| “Too complicated to manage” | Auto mode = zero headache |

🔑 Key Benefits of NPS (Why You Should Care)

- ✅ ₹50,000 extra tax deduction (over 80C)

- ✅ Low-cost fund structure (under 0.1%)

- ✅ Equity + debt in one account

- ✅ Employer match (if offered)

- ✅ Auto-adjusting asset mix

- ✅ Built-in retirement discipline

- ✅ Compounds into ₹1 Cr+ long-term

💡 Pro Tips to Maximize NPS

- Set up auto-debit monthly (₹4,167 = ₹50K/year)

- Use Active choice if you understand equity/debt

- Pick fund managers like HDFC, ICICI, SBI

- Track performance once a year

- Combine NPS with ELSS + PPF for tax planning

❓ FAQs: NPS for Salaried Indians

Q1. Can I exit NPS before 60?

Yes.

After 3 years, you can withdraw up to 25% for specific needs (health, marriage, etc.).

Full exit before 60 has some conditions but is possible.

Q2. What’s Tier II in NPS?

Tier II = no tax benefits

Used for extra savings (like mutual funds)

You can skip this if you’re focused only on tax + retirement.

Q3. Is NPS safe?

Yes — regulated by PFRDA, managed by top fund houses, and offers diversified investment.

Q4. How do I know which fund manager is best?

Compare past performance on CRA portals or ETMoney, Groww.

Most salaried users pick SBI or ICICI for stability.

Q5. Can I use NPS + PPF + ELSS together?

Yes, and you should!

They complement each other beautifully:

- NPS: Long-term

- PPF: Safe

- ELSS: Fast growth

📥 Download Your Free NPS Tax-Saving + Wealth Planner (Excel + PDF)

Want to know:

- How much tax you’ll save with NPS?

- What your corpus will be at 60?

- Which asset mix suits you best?

We’ve built a calculator and cheat sheet just for you.

✅ Plug in your age and investment

✅ Get final corpus + tax savings

✅ Choose the right asset strategy

✅ Works for Tier I account holders

👉 [Download NPS Tax Planner + Asset Mix (FREE Excel & PDF)]

(Insert CTA button or link)

Final Thought: NPS Is Not Just for Retirement. It’s for Freedom. 🧘♂️

Don’t look at NPS as a “boring” pension thing.

Look at it as:

✅ A legal way to slash taxes

✅ A powerful wealth creator

✅ A system that forces you to think long-term

Start today with just ₹4,000/month.

Your future self will thank you — big time.