Introduction

If you’re searching for a budget-plan-single-tier-2-india, you’re in the right place. Living on a ₹25,000–₹35,000 salary in affordable cities like Bhopal, Indore, or Coimbatore can be financially empowering—with the right budgeting approach. This guide helps you build a solid monthly plan with real examples, smart saving tips, and a free Excel template.

Moving to a Tier 2 city like Bhopal, Indore, or Coimbatore on a ₹25,000–₹35,000 salary? You’re not alone. Many working professionals in India live independently in affordable cities, but often struggle with financial discipline.

This post gives you a practical, flexible budgeting method based on real expenses, plus a free Excel download to manage your finances better.

Why Tier 2 Cities Make Budgeting Easier

Compared to Tier 1 metros, Tier 2 cities offer:

- Lower rent (₹3,000–₹7,000 for single rooms)

- Cheaper transportation

- Affordable groceries and eating out

This makes them ideal for building financial discipline early in your career.

What’s Your Salary? Let’s Break It Down

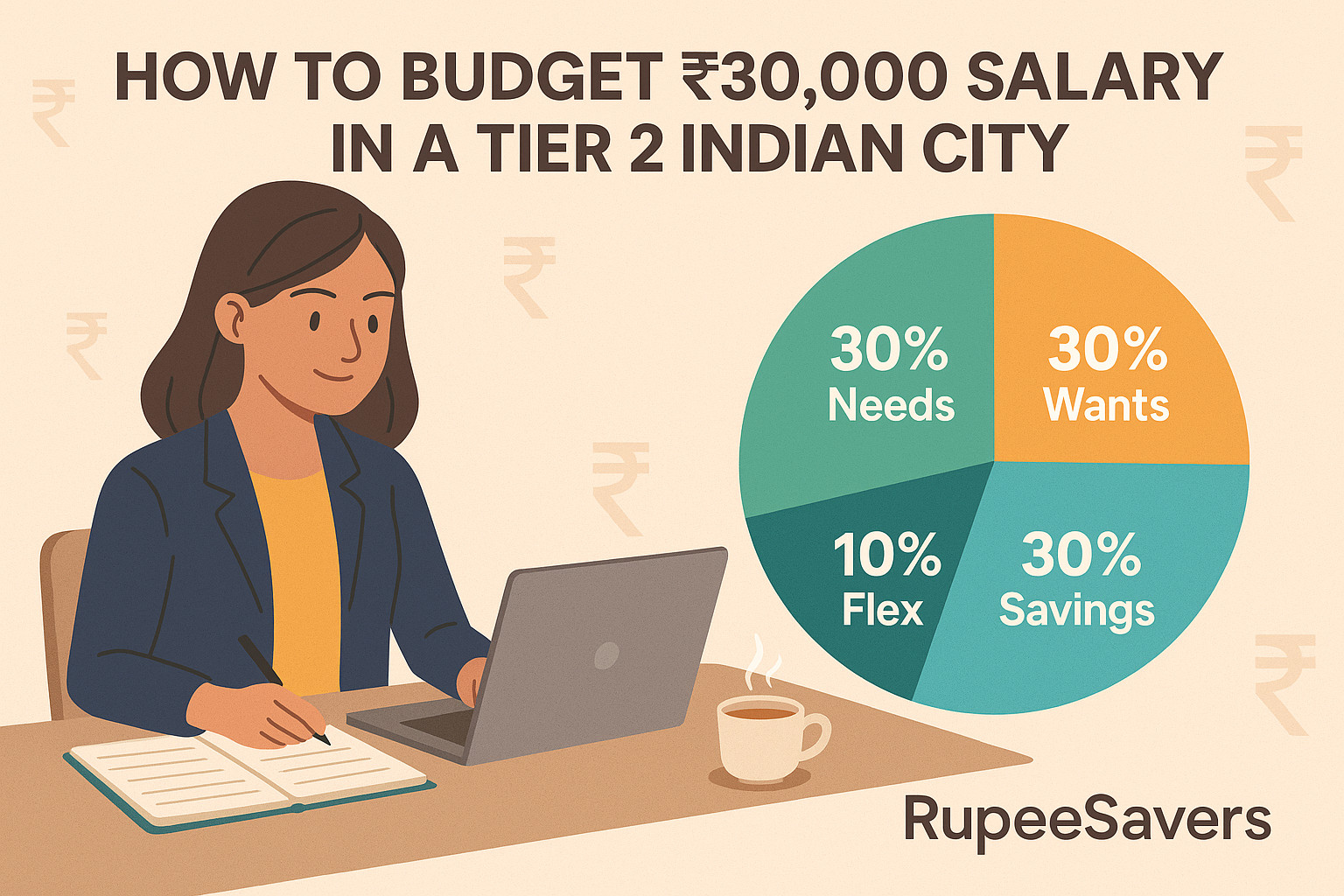

Here are sample monthly breakdowns for different salaries using the 30-30-30-10 rule:

| Salary | Needs (30%) | Wants (30%) | Savings (30%) | Flex (10%) |

|---|---|---|---|---|

| ₹25,000 | ₹7,500 | ₹7,500 | ₹7,500 | ₹2,500 |

| ₹30,000 | ₹9,000 | ₹9,000 | ₹9,000 | ₹3,000 |

| ₹35,000 | ₹10,500 | ₹10,500 | ₹10,500 | ₹3,500 |

Realistic Expenses in Cities Like Indore & Coimbatore

- Rent (shared/studio): ₹4,000–₹6,000

- Food & Groceries: ₹2,500–₹3,500

- Internet + Electricity: ₹800–₹1,500

- Daily Transport: ₹1,000–₹1,500

- Entertainment: ₹1,000

- SIP or Recurring Deposit: ₹2,000–₹5,000

City-Specific Budget Examples

Jaipur Budget Snapshot (₹30K Salary):

- Rent: ₹6,000 (private room)

- Food: ₹3,000

- Utilities: ₹1,200

- Transport: ₹1,000

- Wants: ₹6,000

- Savings + SIP: ₹9,000

- Flex: ₹3,000

Coimbatore Budget Snapshot (₹25K Salary):

- Rent: ₹4,000 (shared)

- Food: ₹2,500

- Utilities: ₹1,000

- Transport: ₹800

- Wants: ₹6,000

- Savings + SIP: ₹8,000

- Flex: ₹2,000

Indore Budget Snapshot (₹35K Salary):

- Rent: ₹6,500 (studio)

- Food: ₹3,500

- Utilities: ₹1,300

- Transport: ₹1,000

- Wants: ₹7,000

- Savings + SIP: ₹10,500

- Flex: ₹3,500

Download Your Free Monthly Budget Template

👉 Download Excel Budget Planner

Track income, expenses, and even your savings goals — all editable and mobile-friendly.

Tools That Can Help (Affiliate-Ready)

| Tool | Purpose | Cost |

| ETMoney | Expense tracking, SIPs | Free |

| INDmoney | Mutual fund & stock investing | Free |

| Groww | Direct mutual funds, gold, FDs | Free |

| Cred | Credit card payment rewards | Free |

Try them and automate your finances.

Case Study: How Ramesh Saved ₹60,000 in a Year

Ramesh, a 26-year-old working in Coimbatore, earned ₹28,000/month. By tracking expenses and following the 30-30-30-10 method, he:

- Saved ₹3,000 every month via SIPs

- Avoided credit card debt

- Built a ₹30K emergency fund in 10 months

- Invested in a health plan worth ₹6,000/year

This simple strategy changed his financial future.

Budgeting Mistakes to Avoid

- Living alone with high rent when you can share

- Eating out 5+ times a week

- Using EMI for gadgets or clothes

- Not saving anything first

- No emergency fund

Avoid these and you’re already ahead.

How to Start a SIP with Just ₹500

- Download Groww or INDmoney

- Complete KYC in 5 minutes

- Search for a large-cap index fund (e.g., UTI Nifty 50)

- Set auto debit of ₹500 monthly

- Let it grow passively over 5–10 years

This is how compounding starts.

FAQs

Q: Can I save on a ₹25K salary in a Tier 2 city?

Yes. With planning, saving ₹2,000–₹4,000/month is realistic.

Q: Should I use SIPs or Recurring Deposits?

Start with SIPs for long-term growth. Use RDs only for short-term saving.

Q: Where should I keep my emergency fund?

Use high-interest savings or liquid mutual funds.

Final Thoughts + CTA

Tier 2 cities offer a hidden advantage: affordability. With discipline and the right tools, you can achieve big financial goals even on a modest salary.

✅ Download the free Excel template and comment below: What’s your biggest monthly expense?

✅ Share this post with your flatmate or colleague who’s still living paycheck to paycheck!